When two big clouds collide and merge a lot of tumultuous activity follows including heavy winds, thunder and lightning. Some of what happens next depends on which one is the dominating cloud in terms of size, density and energy. The people who are nearby naturally witness this activity, are in awe of nature in action, and would certainly love to see a beautiful rainbow eventually emerge as the final outcome.

These causes and effects are very similar to companies going through a merger. How should companies work to help the dust settle to truly capitalize on the efficiencies and productivity gains the M&A deal is meant to bring about? Where does that leave the focus on innovation? Can the merged entity shape a new culture and create those vital connections between its people? How to chart a new course and ensure everyone has an opportunity to participate? Is it possible to ensure the new strategy will be based on diversity and an inclusive approach?

These are some of questions companies face after the merger and sometimes struggle with for many years to come. Even though research indicates that only 50% of M&A deals are successful, 2015 was the biggest M&A year ever with over $4.3 trillion in acquisitions globally. Planbox has also witnessed a large percentage of our customer base going through major M&A activity in the past twenty four months. As the new leadership team is announced and a strategy takes shape the new merged organization quickly finds itself with lofty corporate objectives that usually include major growth targets, complex process improvement activities and productivity gain expectations being announced as the people and culture of the new company are going through a fundamental transformation. Significant challenges quickly become apparent and more than ever before there aren’t enough good answers to help overcome these obstacles.

Anyone who has gone through a merger knows things don’t quite work out as originally planned. The rosy picture and “high level plan” that seems so right the day the deal is announced quickly meets reality and for at least the next twelve to twenty four months there is a lot of uncertainty and heavy lifting involved.

Companies are starting to recognize the importance of holding a “Jam Session” as the first important post-merger activity to help make the new ship head in the right direction, and to tap into the incredible wealth of new and existing knowledge and relationships that will serve it well on the new journey.

We define an Innovation Jam as a massive opportunity to listen and engage. What a great way to get started after the M&A deal is done for the leadership to share their vison and then just listen to people who have so many valuable observations, questions, comments and feedback.

“You never get people’s fuller attention than when you’re listening to them.” – Robert Brault

What is a Jam Session and how does it work?

The basic premise of the Jam is for the organization to cast a wide net that engages everyone and invites them to participate in solving new and existing problems as well as to just gather comments and connect people across the entire organization.

It all starts with the CEO or the leadership team which defines the “Strategy”. following a merger or acquisition. Then “Corporate Objectives” are defined to execute on that strategy. Next the main “Challenges” the company or certain divisions will face are determined based on stated strategic objectives. The organization then launches a Jam Session with its employees, and potentially partners, suppliers and customers to get “comments and feedback”. This gives everyone a “voice” and the opportunity to influence the company’s focus and investment priorities.

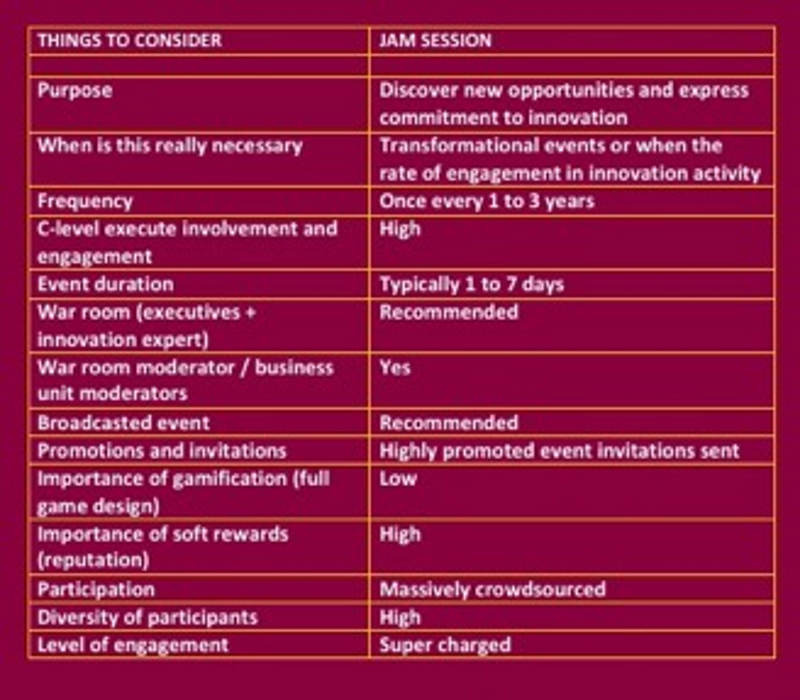

The intent is to encourage a high level of engagement, for people to have a conversation, and to solicit as much feedback as possible. Planbox customers have seen engagement rates upwards of thirty to forty percent in such sessions – well above the five to ten percent engagement rates organizations typically report without a systematic approach. A daily “tag cloud”, leaderboards, and other instant reports are then used to analyze the buzz that the Jam session is generating which also helps with guiding and moderating the enterprise-wide conversation throughout the event. The jam session forms a solid foundation to follow through by focusing on generating ideas based on identified improvement or investment opportunities and start the new innovation journey for the merged organization. Here are some Jam Session fundamentals:

We have seen a significant uptick in Jam Sessions to help organizations communicate their vision and strategic objectives. As the M&A deal is completed and the new cloud gets formed, remember that there is a pot of gold at the end of the rainbow and a Jam Session is the key innovation activity to help you get there!

Please share your stories if you have gone through an M&A process and what your organization did right to increase engagement, encourage innovation and to bring everyone in the new organization under one roof as soon as possible.